| Publication 596 |

2008 Tax Year |

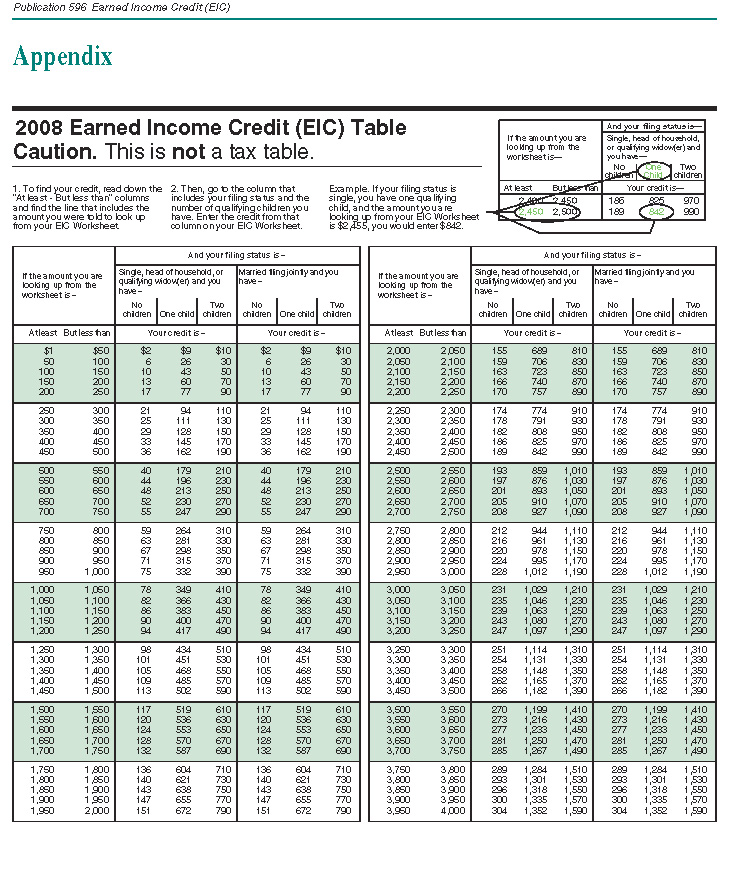

2008 Earned Income Tax Credit Tables - Page #1

| 1. To find your credit, read down the “At least - But less than” columns and find the line that includes the amount

you were told to look up from your EIC Worksheet.

|

2. Then, go to the column that includes your filing status and the number of qualifying children you have. Enter the

credit from that column on your EIC Worksheet.

|

Example. If your filing status is single, you have one qualifying child, and the amount you are looking up from your EIC

Worksheet is $2,455, you would enter $842.

|

| |

And your filing status is-

|

|

If the amount you are looking up from the worksheet is-

|

Single, head of household, or qualifying widow(er) and you have-

|

Married filing jointly and you have-

|

| |

No children

|

One child

|

Two children

|

No children

|

One child

|

Two children

|

|

At least

|

But less than

|

Your credit is-

|

Your credit is-

|

Index | Next

SEARCH:

You can search for information in the entire Tax Prep Help section, or in the entire site. For a more focused search, put your search word(s) in quotes.

Publication Index | Tax Prep Help Main | Home

|